Social Media Means

Social Media Means

Social Media Means

Social Media Means

Photo: Leeloo Thefirst

Photo: Leeloo Thefirst

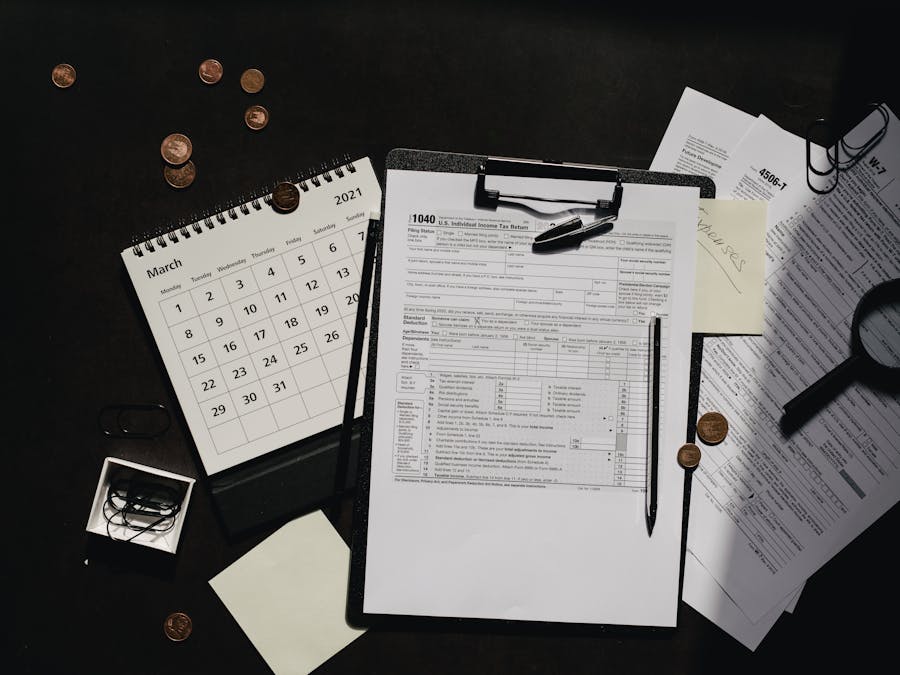

It's only when you fail to pay what you owe in a timely manner, that your credit score can be affected. The amount of tax you owe is a significant factor in determining whether your credit score will be affected. This is because your credit is only affected once the IRS files a Notice of Federal Tax Lien in court.

The Deloitte survey found that 40% of Gen Zers would like to leave their job within two years, and 35% would leave without having another job lined...

Read More »

bachelor's degree Education. To become a social media specialist, you typically need a bachelor's degree. You should expect to study subjects such...

Read More »

TikTok and Reddit are the only two on this list of the fastest-growing social media platforms in the US that saw growth increase by more than 10%...

Read More »

More Tax Guides It boils down to this: If you're getting a sizable refund just about every year and you're having federal taxes held out of your...

Read More »No. If you were a regular employee and get a W-2 for the income you earned, and you had no other income, you do not have to file a tax return if you made less than $6300. But the tax system isn't that simple. If there is an amount in box 2 of the W-2, you are allowed to file to get that back.

No. If you were a regular employee and get a W-2 for the income you earned, and you had no other income, you do not have to file a tax return if you made less than $6300.

Show that you have skills and experience to do the job and deliver great results. You never know what other candidates offer to the company. But...

Read More »

Top 100 Companies With Remote Jobs to Watch in 2022 BroadPath. Liveops. SYKES. Working Solutions. SAP* Varsity Tutors. TTEC. Kelly* More items...

Read More »

1,000-50,000: You're doing alright. If you have a snapscore between 1,000 to 50,000, you might not use snap too often. It is likely that the only...

Read More »

between 10,000 and 100,000 followers A micro influencer has a smaller audience, typically between 10,000 and 100,000 followers.

Read More »