Social Media Means

Social Media Means

Social Media Means

Social Media Means

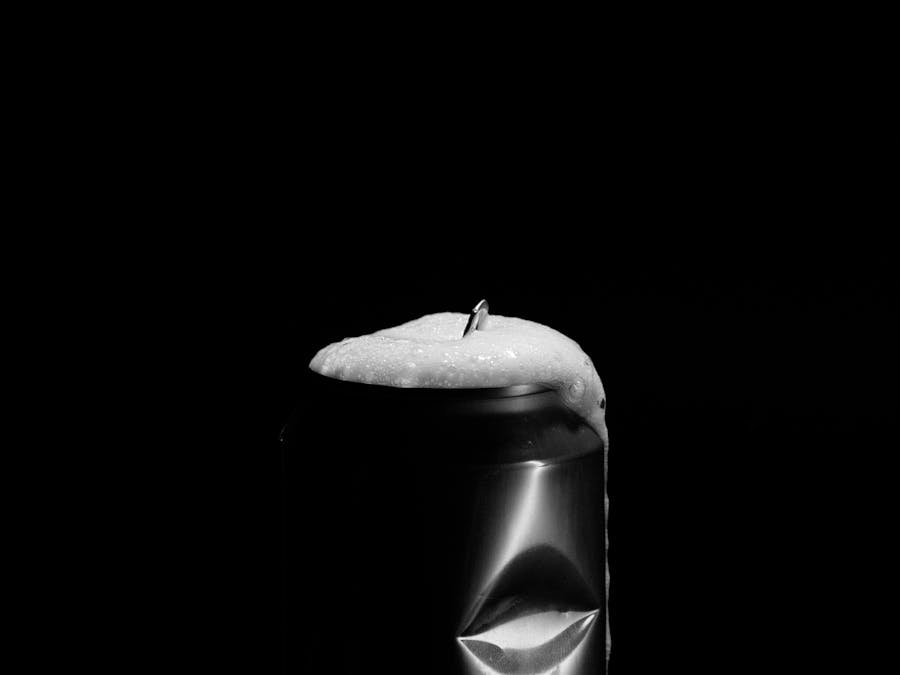

Photo: Pixabay

Photo: Pixabay

$41,600 a year For most full-time jobs, that's 40 hours per week or 2,080 hours per year, if you don't take any time off. That means $20 an hour is $41,600 a year.

37 Best Low-Stress Jobs To Keep You Calm At Work (2022) Massage Therapist. Average Annual Salary: $43,000. ... Orthotist or Prosthetist. Average...

Read More »

Unfortunately, it seems that liking your own TikTok does absolutely nothing to boost its performance – at least not directly. Liking your own...

Read More »

Some historians link the 00 designations to Fleming's World War II service as a real-life Naval officer working in British military intelligence in...

Read More »

The 7Ps of marketing are – product, pricing, place, promotion, physical evidence, people, and processes. The 7 Ps make up the necessary marketing...

Read More »The example doesn’t include state income taxes or other deductions or strategies to lower your tax bill. Most states use a progressive tax system similar to the federal government’s. Nine states use a flat rate:

25 High-Paying Jobs That Don't Require a Four-Year Degree Air Traffic Controller. Median salary: $129,750. Elevator Installer and Repairer. ......

Read More »

Our final result is a hundred quintillion . Jun 23, 2015

Read More »

There are a number of self-publishing companies that allow users to create physical copies of their books and sell them via major retailers. Most...

Read More »

The good news is, there's no strict minimum. Three influencers Insider interviewed — all with under 3,000 Instagram followers — said they got paid...

Read More »