Social Media Means

Social Media Means

Social Media Means

Social Media Means

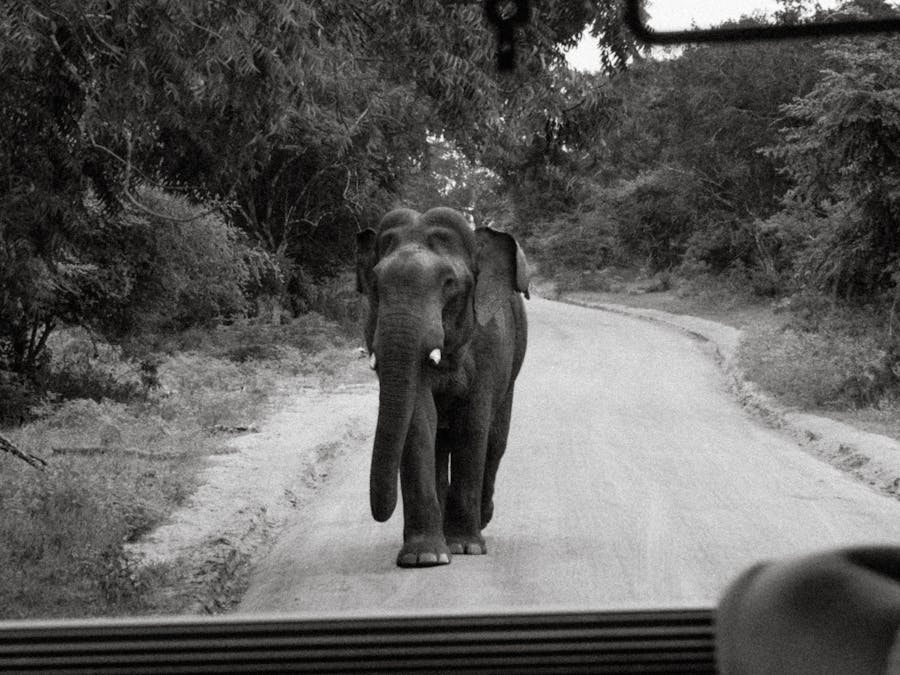

Photo: Ann H

Photo: Ann H

An $80 an hour rate equals a gross annual income of approximately $166,400 if you work a 40-hour week for 52 weeks a year. Remember that taxes, where you live, and the number of hours you work will affect the exact take-home dollar amount. Determining yearly salary from your hourly wage can be a bit deceptive.

7 Steps To Become A Full-Time Influencer | LTK Step 1: Identify Your Niche. ... Step 2: Select Your Platform. ... Step 3: Understand Your Audience....

Read More »

15 Kinds Of Annoying Friends We All Have The one who acts like your mother. ... The one who checks your cell phone. ... The one who always cribs....

Read More »Article Summary: An $80 an hour rate equals a gross annual income of approximately $166,400 if you work a 40-hour week for 52 weeks a year. Remember that taxes, where you live, and the number of hours you work will affect the exact take-home dollar amount. Determining yearly salary from your hourly wage can be a bit deceptive. You see that a job has a nice hourly pay, but it’s easy to forget that your gross income won’t be anywhere near your take-home pay (at least after income tax is applied). You also have to remember that salary is a technical term. Salaried employees are typically exempt from certain employment situations and restrictions that will explicitly apply to employees whose pay is calculated hourly. So how big is your gross annual salary if you make $80 an hour? What do you actually get to take home from that salary? In this article, we dive deep into hourly-to-salary calculations, how federal and state taxes vary depending on your wage, and what you can do to make the most of your take-home pay. Get Competing Personal Loan Offers In Minutes Compare rates from multiple vetted lenders. Discover your lowest eligible rate. Get Personalized Rates It's quick, free and won’t hurt your credit score

The 10 Happiest and Most Satisfying Jobs Dental Hygienist. Physical Therapist. Radiation Therapist. Optometrist. Human Resources Manager.

Read More »

US $49.5 billion As of October 2022, Zhang's personal wealth was estimated at US$55 billion according to Bloomberg Billionaires Index (US $49.5...

Read More »

Inetimi Timaya Odon, better known by his stage name Timaya, is a Nigerian singer and songwriter. He came into limelight after he released his track...

Read More »

High Paying Sports Jobs Sports Statistician. Salary range: $41,500-$100,000 per year. ... Head Tennis Professional. Salary range: $47,500-$98,000...

Read More »Pro Tip Although paying a higher tax rate is never fun, remember your take-home pay will always be higher when you get a raise. However, the percentage share of your after-tax income will get smaller.

11 Highest Paying Jobs With Zero Experience Required Virtual Assistant. Flight Attendant. Freelance Writer. Real Estate Agent. Certified Nurse...

Read More »

Google has started emailing users of very old Android devices to tell them it's time to say goodbye. Starting September 27, devices running Android...

Read More »

Jane Addams (1860-1935) Perhaps the most famous and decorated female social worker, Jane Addams founded one of the world's first settlement houses...

Read More »

No, Facebook isn't going away anytime soon. Yes, Facebook may still be relevant a decade from now. And it's likely the company will continue to...

Read More »