Social Media Means

Social Media Means

Social Media Means

Social Media Means

Photo: Leeloo Thefirst

Photo: Leeloo Thefirst

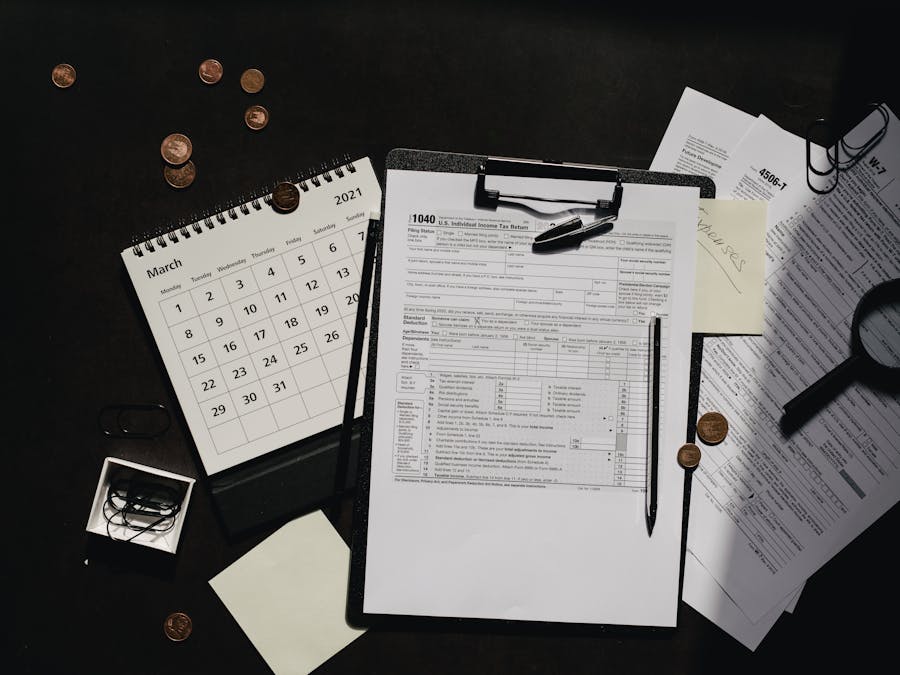

More Tax Guides It boils down to this: If you're getting a sizable refund just about every year and you're having federal taxes held out of your pay, you're probably having too much held out for federal taxes. So when you get a big refund, you're just getting your own money back.

20 successful referral program examples GetResponse – $30 account credit per referral. Hostinger – 20% commission. Dropbox – Up to 32 GB per...

Read More »

Lack of confidence and low self-esteem act as a big stop sign to the career of our dreams. The feelings of underconfidence and not believing in...

Read More »Getting a big tax refund check from the IRS is so nice, right? You can always find a use for that money, whether it's a big-ticket purchase, paying off a debt, or just adding to your savings. But by getting that big refund every year, you're missing out on even more money. It boils down to this: If you’re getting a sizable refund just about every year and you’re having federal taxes held out of your pay, you’re probably having too much held out for federal taxes. So when you get a big refund, you’re just getting your own money back. True, it’s sort of a mandatory savings account that pays off once a year, but you’re still losing money on the deal. That’s because the IRS gets to use your money for most of the year, without paying you any interest.

B2B stands for 'business to business' while B2C is 'business to consumer'. B2B ecommerce utilises online platforms to sell products or services to...

Read More »

$560 to $6,935 For the 2022 tax year, the earned income credit ranges from $560 to $6,935 depending on tax-filing status, income and number of...

Read More »If you make $70,000 a year living in the region of California, USA, you will be taxed $17,665. That means that your net pay will be $52,335 per year, or $4,361 per month. Your average tax rate is 25.2% and your marginal tax rate is 41.0%.

Users had to use the fame to find other sources of earnings like brand deals, promotions, etc. But now, TikTok is paying real money to creators for...

Read More »

How to find purpose in life: 12 tips Develop a growth mindset. Having a growth mindset is linked to having a sense of purpose. ... Create a...

Read More »

TikTok offers users the ability to see how many times their video has been watched, but does not show which individual users or accounts view it....

Read More »

17 ways to get more Instagram followers Incorporate Reels into your content mix. Cross promote content. Curate your profile grid. Work with brand...

Read More »